There are always costs to take into consideration when you buy a property. One of the biggest is stamp duty, which falls on the buyer. Stamp duty costs vary depending on whether you are a first-time buyer, moving home or buying an additional property. Let’s take a closer look.

What is stamp duty?

Stamp duty is short for stamp duty land tax, which is charged by HM Revenue and Customs when you buy a property. The buyer pays it and the amount depends on the property location, the purchase price, and your own buyer status; for example, if the property is worth under £40,000, it is completely exempt from this tax.

The stamp duty payment is made by the solicitor on the buyer’s behalf after the sale has completed.

What is the nil-rate band?

From 1 October 2021, no stamp duty is due for the first £125,000 of the value of the property. This tax is weighted in your favour if you are a first-time buyer, as you will pay no stamp duty on the first £300,000 of the value.

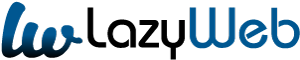

On the other hand, if you are buying an extra property, you will pay three per cent stamp duty as a minimum. This rate increases according to different bands. Non-UK residents are also charged a 2% surcharge on this tax.

Stamp duty is complex and depends entirely on your buyer status, the property location, and the value of the property. England and Northern Ireland have different rates than Wales and Scotland. For conveyancing in Bromley, conveyancing specialists such as Sam Conveyancing can provide the advice you need to calculate the stamp duty you will be charged on the property you are interested in buying.

How much is stamp duty?

The rate you pay depends on the price threshold your property falls into and where the property is – there are different rates in Scotland and Wales to England and Northern Ireland. It also depends on whether you have to pay a surcharge because you are purchasing a buy-to-let or second home. The current rates are:

– 0% cent for properties up to £125,000 unless you are buying an additional property, in which case it is 3%.

– 2% for properties between £125,001 and £250,000, and 3% for second-home buyers.

– 5% for properties between £250,001 and £925,000, and 8% for additional property buyers.

– 10% to 13% for properties between £925,001 and £1.5m.

– 12% to 15% for any property over £1.5m.

The rates for Scotland are slightly different, with the first-time buyer stamp duty relief levied on properties valued up to £175,000. Figures for Wales are also different, where the levy is called land transaction tax and has no relief for first-time buyers.

What about first-time buyers?

In England and Northern Ireland, you will pay no stamp duty on the first £300,000 of a property’s value and 5% on properties up to £500,000. No relief is given for properties valued at more than this. You and anyone else you are buying with must be a first-time buyer to be eligible.

Are there any other exceptions?

Yes, other exceptions exist when it comes to stamp duty. Examples include:

– If the property is worth under £40,000.

– If the property costs over £500,000 and is being bought by a company.

– If charities are buying property or land for their charitable work.

– Possible discounts for buy-to-let transactions.

– Relief for registered social standards.

– Zero-carbon houses and flats worth under £500,000 are also exempt.